BANK SCAMS

Varghese Pamplanil

Readers of Church Citizens' Voice (CCV) are very fortunate to have an erudite writer like Mr Varghese Pamplanil who has a rich and vast reservoir of knowledge. His crystal clear insights are evident in all his articles and letters in CCV. The other day, I requested Mr Varghese to enlighten readers on bank scams.

Readers of Church Citizens' Voice (CCV) are very fortunate to have an erudite writer like Mr Varghese Pamplanil who has a rich and vast reservoir of knowledge. His crystal clear insights are evident in all his articles and letters in CCV. The other day, I requested Mr Varghese to enlighten readers on bank scams.

Overreaction by banks and investigative agencies to the Rs. 12,600 crore fraud on state-run Punjab National Bank (PNB) which came to light last month could hurt essential credit disbursement to trade and industry, tempering growth expectations, industry association Assocham said on Sunday, 11th March 2018. "So, it is time to show immense restraint and use the adverse situation as an opportunity to fix the systemic issues," Assocham Secretary General D.S. Rawat said in a statement. Pointing out that letters of credit (LOC) or letters of undertaking (LOU) allegedly misused by the diamond traders are legitimate instruments in global trade, Assocham said: "While we may seek long-term solutions like privatisation of the banks, the need of this hour is to rally around honest bank officers and the honest business entities which have built trust on each other." (Source: NDTV Business | Indo-Asian News Service 11 March 2018).

Having been with the Reserve Bank of India and retired as its Deputy General Manager, I am sure readers will agree that whatever Mr Varghese shares, it will be from a position of strength. So let us enrich ourselves from his first-hand experience on banks and banking scams and his suggestions to stem the rot. Isaac Gomes, Asso. Editor, CCV.

Varghese Pamplanil

About the suggestion of Isaac Gomes that I may be able to throw some light on the recent bank scams, let me say that I retired from RBI on 31st October 2000. For some years, I have been keeping track of RBI Annual Reports and other periodical publications to be aware of what was happening . I also used to follow developments in the world of finance and economy and topics related thereto. At the moment, I give only give casual attention to these matters. In the community, where I live now, there is hardly anyone interested in talking about these things. Almost all of them are concerned and worried about the low prices of natural rubberand other agricultural produce, the main sources of their income vis-vis-vis the increasing prices for the products they are required to buy. When the pangs of hunger and deprivation knocks at the door, one can hardly be a philosopher. Many others are engaged in self-flagellation for the sins they think they havecommitted against their God; fasting and beating their chests and praying for forgiveness. Then there are experts on all the topics under the sun and know alls. An old man like me better keep quiet, confining himself in watering a few tomato plants and other sundry vegetables grown with difficulty.

I had keenly followed the nuances of the 2008 financial meltdown. What caused the world financial crisis was the overriding greed of brokers in the Wall Street and the unbridled trading in opaque financial products called derivatives. In many cases, the derivatives spawned further derivatives without bothering about the quality of the underlying transaction: mortgages, the prime transaction, where the capacity to repay the loan was suspect.

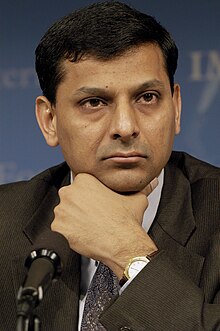

Identification of frauds is rather tricky, especially if they pertain to off-balance sheet items. In this category belongs, Letters of Credit/ comfort letters issued by banks and bank guaranties. In a paperless system spoors are hard to be left for the examiner to identify the misdemeanours. Transactions of these types are cleverly concealed. In his speech at the FICCI-IBA Annual Banking Conference on 16 August 2016, Dr.Rajan, the then RBI Governor had warned: “with the changes in technology, cyber security, both at the bank level and at the system level, has become very important…..We all have to examine our security culture. Too many access points are left uncovered, too many people share pass words or have easily penetrated passwords, too little surveillance is maintained of vendors and the software they create”.

The former Governor had also observed: “The governance of public sector banks can be improved only when the Government distances itself fully from the banks, creates a transparent and professionalised process for appointing its directors on the boards (not dominated by governing party favourites or current or retired government bureaucrats) and allows bank boards both autonomy as well as accountability in picking and compensating bank management.”

Banking is based on trust and the moral integrity of all the players involved. Market intelligence may be of help in identifying frauds. For this, one has to listen to the vibrations on the ground. If a person becomes suddenly rich without ostensible reasons, something fishy can be smelt. Such a person has a tendency to flaunt his wealth and splurge money. He spends lavishly and is in the forefront of attention grabbing. He keeps company with the tinsel world and the jet set. Hard earned honest money is never thrown down the drain. But who cares, when people who count are wined and dined and plied with irresistible and alluring goodies.

Normally no law-abiding honest person can become overtly rich overnight. The exception could be extremely talented individuals like Steve Jobs, Bill Gates, Warren Buffet, Elon Musk, Zuckerberg, Jeff Bezos who earn billions by their brilliance and audacity. But in India, wheelers, dealers and fixers corner the wealth of the country. They are in cahoot with people wielding power. These “crony capitalists” resort to any method to achieve their ends by prostituting the system. In an environment, where almost every one is on the look out for free lunches, eyes are closed like the proverbial cat drinking the milk. But who except a lone Gauri Lankesh has the courage to stand up and come to grief being shot dead in cold blood. All of us, by and large, are busy saving the skins of the self and our dear ones. All the protestation is limited to giving exercise to one’s vocal cord.

Dr Raghuram Rajan, 23rd Governor of Reserve Bank of India (4 September 2013 – 4 September 2016)

Permit me to quote from the book “I do what I do” by Dr. Rajan, one of the best Central Bank Governors in the world, an internationally acclaimed economist and financial expert, who in 2005 predicted the 2008 bust, “Let me emphasise that the RBI takes its mandate from the RBI Act of 1934, which says that the Reserve of India is constituted ‘to regulate the issue of Bank notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its best advantage….The primary role of the central bank, as the Act suggests, is monetary stability, that is, to sustain confidence in the value of the country’s money. Ultimately, this means low and stable expectations of inflation, whether that inflation stems from domestic sources, or from the changes in the value of the currency, from supply constraints or demand pressures…..we are among the large countries with the highest consumer price inflation in the world. Much of the inflation is concentrated in food and services………. ultimately inflation comes from demand exceeding supply, and it can be curtailed only by bringing both in balance.” Inflation affects the people at the bottom of the economic pyramid most, with disastrous consequences.

Dr. Rajan’s take that “strong governments, may not, however, move in the right direction” was not viewed kindly by those in the corridors of power. He went on to say “Hitler provided Germany with extremely effective administration –the trains ran on time, as did the trains during our own Emergency in 1975-77. His was a strong government, but Hitler took Germany efficiently and determinedly on a path to ruin, overriding the rule of law and dispensing with elections…..The physical rail network guiding the trains could be thought of as analogous to rule of law, but the process by which consensus is built around the train schedule could be thought of as democratic accountability”

He opines further “India needs a strong and independent RBI to ensure macro- economic stability…in this environment, the central bank has to occasionally stand firm against the highest echelons of central and state governments. The Reserve Bank cannot just exist, its ability to say ‘No!’ has to be for the interests of macroeconomic stability, none of these things should be changed, though, if these issues ever existed; there may be some virtue in explicitly setting the Governor’s rank commensurate with his position as the most important technocrat in charge of economic policy of the country …. The RBI Governor, as the technocrat with responsibility for the nation’s economic risk management, is not simply another bureaucrat or regulator, and efforts to belittle the position by bringing it into the bureaucratic hierarchy are misguided and do not serve the national interest. More clarity about RBI’s role and a clearer assertion of its independence would be in the nation’s interest. ”Unfortunately the Government and its bureaucracy views the RBI as subservient to the Finance Ministry and the favourite whipping boy, if some thing goes wrong on account of systemic faults."

Thus the role of a Central Bank is macro oversight and not micro audit. The Bank of England, the model of which was adopted in setting up the RBI, does not conduct any on sight inspection, but relies on Reporting Accountants akin to Chartered Accountants in India. To the credit of RBI, after the liquidation of the Palai Central Bank towards the end of the 1950s, no bank depositor has lost his/her savings. Even if RBI deploys persons equivalent to the number of Indian Armed forces, individual transactions in banks running into billions, cannot be picked up.

Everyone works for an institution or industry for making a living. Altruism and sacrifice are nice words to mouth from the other side of the fence but there are no takers in the real world. One of attractions that prompted me to opt for RBI was the comparatively better remuneration offered by it when compared to government service. The RBI provided career opportunities based on merit. The parameters of remuneration had sea- change after the 1960s when the babus of the Central Government ensured that the pay scales of banks are kept below that of the government staff. We have to remember that bank staff deals with monetary assets and money is a temptation even for a saint. I was keen to keep my job, so no hanky-panky in money matters. That was the sane message given to me by well-meaning senior officers.

A combination of factors have changed the rules of the game. Shirkers and bribe taking persons decide the fate of others. Persons incapable of getting gainful employment by merit, control the levers of power and loot the system. A nation led by competent people, especially engineers and technocrats with integrity alone will lift our country from the morass of deprivation.

The last sentence says it all. When will our Babus learn they are no match to technocrats and stop demanding higher pay than our soldiers and those who are exposed daily to high risks like the RBI Governor and the top banking brass?