Cashless or clueless?

Express News Service | Published: 11th December 2016

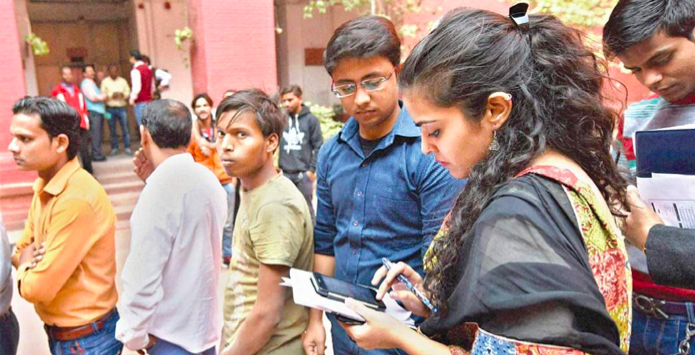

Bank employees train Finance Ministry staff on mobile banking and cashless transactions in New Delhi on Tuesday | PTI

(Note: “A very good idea very badly implemented, hurting the poor, the most” is the most polite thing we can say about Modi’s implementation of demonetization plan.

(Note: “A very good idea very badly implemented, hurting the poor, the most” is the most polite thing we can say about Modi’s implementation of demonetization plan.

There is a saying in Malayalam: “Don’t try to stretch both your legs together before you sit down!” All can imagine what will happen – fall on the buttocks. That is what is happening to illiterates, uneducated, those with no smart phones, and people in rural areas where no banks are anywhere near.

Still Modiji team is blundering along saying: “The tiger I caught has three horns, not two!” He also changes goal posts too often to play on the short memory of people. The craziest thing is there is no dearth of unthinking senseless people in India, to blindly believe even such tall talks.

Basic education and smart phone literacy should come much before a cashless economy. Will India become fully literate at least by the end of 21st century? james kottoor, editor)

About 16 km from Coimbatore, in a fast developing and predominantly agricultural locality called Thondamuthur, Anandi gets her two children ready for school — a routine unchanged for the last seven years. But in the last week of November 2016, there is one change.

Anandi needs to get the children out of the house by 7 am, an hour earlier than usual, because she needs to go stand in the line outside her bank before it opens for the day. The small stash of hundreds she had withdrawn last week is running out. Anandi is a domestic servant, agricultural worker, and an occasional flower vendor. She is among the 26 per cent of Indians policymakers call illiterate. Her family does not own a smart phone.

Anandi’s situation stands in stark contrast to the Narendra Modi government’s rhetoric over the last few weeks that India is poised for a leap into a “cashless economy”, a leap that no developing nation has dreamed of trying. She personifies the barriers that a nation of 1.3 billion needs to cross before reaching that brave new world: illiteracy, inadequate smart phone penetration, absence of a pan-India, seamless high-speed data network and millions of unbanked people.

How will Anandi make that leap? How’s it even Possible?

In the days following the Nov 8 demonetisation of `500 and `1,000 notes, newspapers were plastered with full page ads by online financial technology firms which wanted to cash in on the sudden withdrawal of 86 per cent of the currency in circulation.

The weeks subsequently saw the same firms announce immense jumps in their subscriptions and transactions. But the geographical spread of these was not disclosed.

In response to an email query from New Indian Express, Paytm, India’s market leader in the mobile transaction space, claimed that nearly 50 per cent of its transactions now were coming from smaller cities and towns. “Thousands of kirana store owners, vegetable and fruit vendors, food stalls, pharmacies and many more merchants across India’s semi-urban and rural areas now accept Paytm…. and after introducing the Paytm android app in 10 regional languages, we are expecting that share to grow to around 70 per cent,” said the company’s spokesperson.

But cities and towns, however small, only account for a little over a quarter of the Indian population. According to the 2011 census, 72.2 per cent of Indians still live in villages, none of which is covered by online grocery firms.

Big Basket is India’s largest online supermarket, but according to its CEO Hari Menon, the company does not have any presence in rural areas. “We do not operate there. In our urban markets, however, we have seen a 50 per cent jump in sales after November 8,” he said.

The story was the same for other online retailers. Transactions jumped, but the large majority of the Indian population does not have the option to turn online, even if they wanted to. But where are the banks in villages?